Apr 25, · Select the Account field and choose Accounts Payable from the dropdown list. Enter the amount under the Debit column, tab to the Name column and select the vendor name from the dropdown list. In the next line, select the offset account and enter the amount under the Credit column. Select Save & blogger.comted Reading Time: 5 mins Apr 22, · Write off invoices in QuickBooks Online Accountant Go to Accountant Tools and select Write off invoices. Set the Invoice Age, To Date, and Balance less than filters to find the invoice. Then, select Find invoices. Review the name in the Customer column. Select the checkboxes for the invoices you Apr 23, · Select the checkboxes next to the invoices you want to write off. On the lower left, from the Write Off Account?drop-down menu, select the account you use for bad debts. Select Preview and Write Off, then review the invoices you choose to write off. Once you're all set, select Write Off. Click to see full answer

Solved: How do I write off an unpaid invoice?

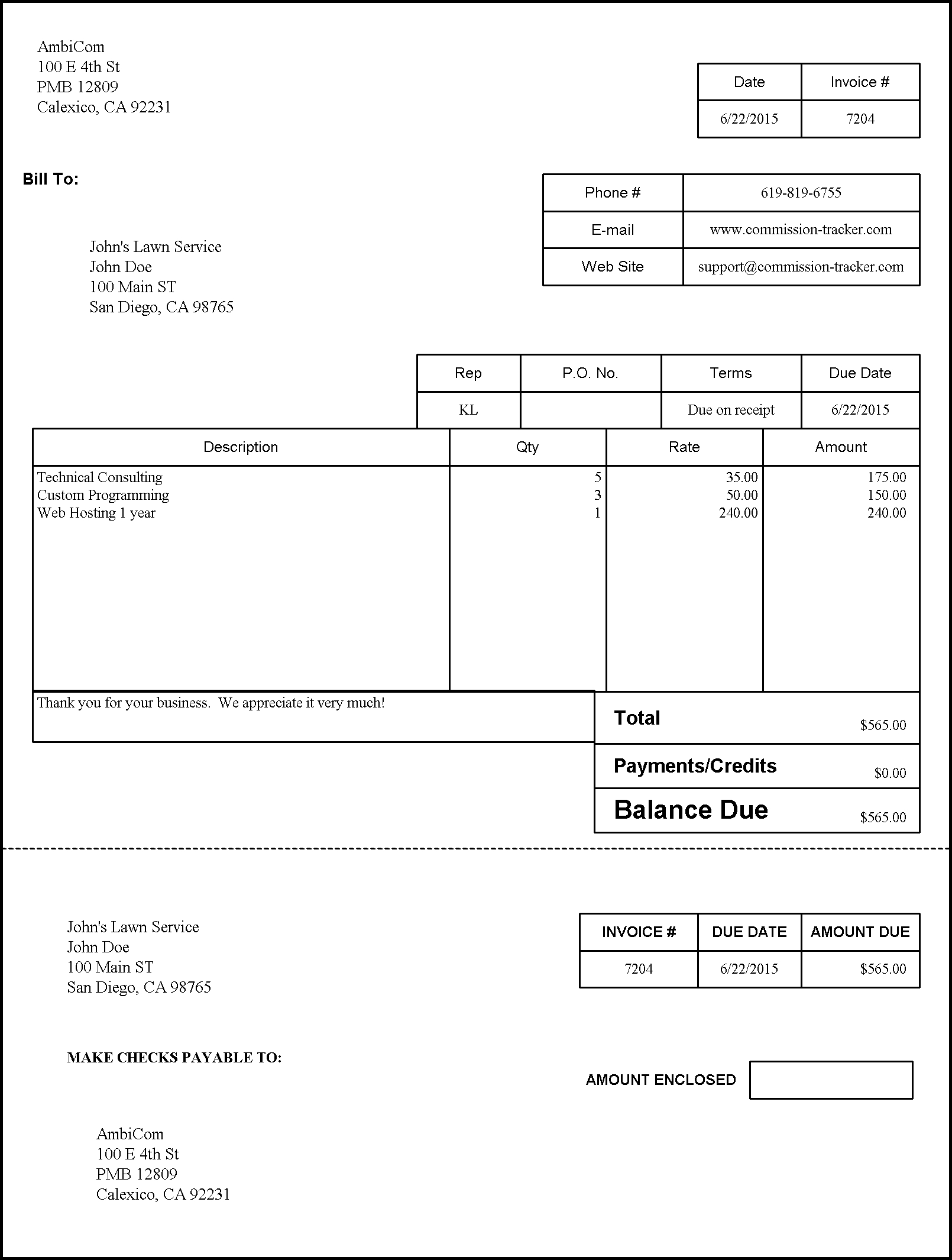

You make a sale and you have dollar signs in your eyes. But sometimes those dollars never actually make it to your bank account. You have Bad Debt, and that can be as ominous as it sounds. How do you deal with it? The first step in writing off an invoice in Quickbooks is to consider your reporting method. Do you report your income on a Cash Basis or Accrual Basis? If you are a Cash Basis entity, that means you don't recognize your income until you have the Cash in your hand, bank account, or pocket.

If you sold something in January but didn't get paid until June, your income happens in June, not January. If you are an Accrual Basis entity, that means you recognize the income the instant it happens, whether you have the actual money yet or not.

So what happens if you never get paid? That depends on your reporting method. Because you report on Cash Basis, you have never recognized this amount as income. Remember, the money has to be in your hand to be income.

If it's still in your customer's pocket, it was never your income. So you have nothing to deduct. No income, no bad debt, how to write off invoices in quickbooks. The easiest way to deal with this situation is to simply void the invoice.

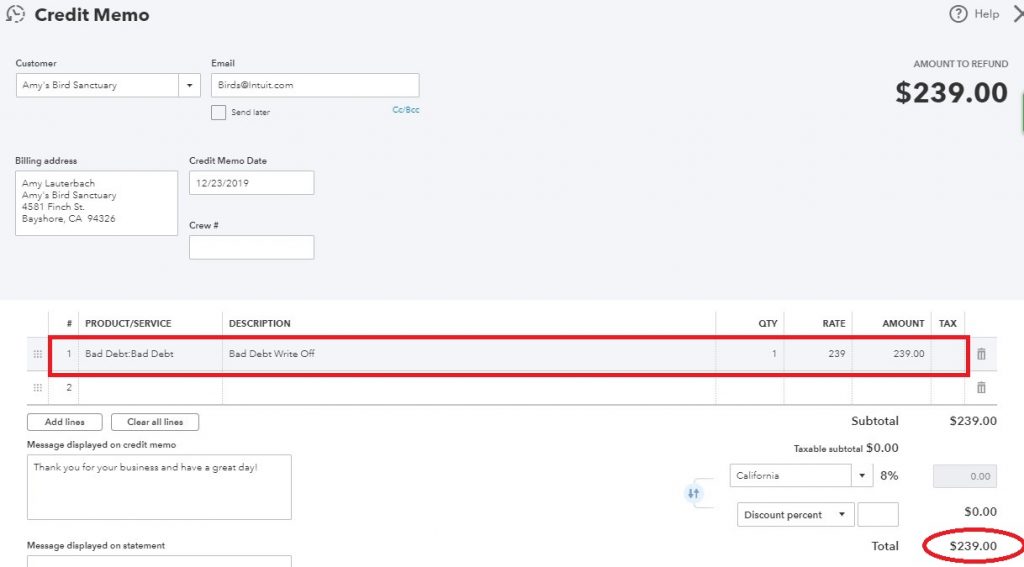

By voiding it, you still show it in your books, just with a balance. You can write notes or memos on the invoice, how to write off invoices in quickbooks. Perhaps something like, "Deadbeat! Refused to pay! If you report on Accrual Basis, how to write off invoices in quickbooks, you do have a debt to write off. You recognized that income when you wrote the invoice, but you don't have the money, and you're sure you'll never get it. This is a Bad Debt. You can also add something in the description if you like.

Don't put an amount because it may be different the next time you have to use it. Point that Product to the Bad Debt Expense you just created. Use the Product Bad Debt on the credit memo form. Even though you still have the income from the original invoice, you have a credit memo offsetting it which shows up in the Bad Debt Expense. The net effect of these two transactions is zero - Money into Income from your invoice, expense from the Bad Debt credit memo. You can if both transactions are in the same tax year.

So use a credit memo in the current year to reduce your income and magically also reduce your tax liability. Believe me, we all wish that. What's the very best thing you can do to make sure your invoices get paid? Make it easy for your customers to pay them. Studies have proven that invoices emailed with a "pay now" link, get paid twice as fast as invoices sent through snail mail.

InvoiceSherpa sends your invoices to your customers, offer a payment link and sends reminders from gentle to stern at the intervals you prefer. We live in the App Friendly Technology age. Apply it to your own finances and make it easy for you and your customers. Make Bad Debt go away and put those dollar signs in your bank account where they belong. How to Write Off An Invoice on Quickbooks. Posted on October 7, Blog. Share on Linkedin Share on Facebook Share on Twitter.

Cash Basis vs. Accrual Basis The first step how to write off invoices in quickbooks writing off an invoice in Quickbooks is to consider your reporting method.

But wait! Easy steps to remove the amount from income and turn it into an expense First, create an account of the type EXPENSE how to write off invoices in quickbooks call it Bad Debt Expense. How InvoiceSherpa works with QBO. Top Tips for Choosing Small Business Accounting Software.

QBO Tutorial - How to Write off Bad Debt in QuickBooks Online

, time: 6:20How to Write Off An Invoice on Quickbooks

Mar 19, · How to Write Off an Invoice in QuickBooks. 1. Open the invoice you are writing off. You will want to refer to the invoice as you proceed through the following steps. To find the invoice: 2. Create a new credit memo. You can find the credit memo feature under the Customers tab in QuickBooks Desktop. Author: Billie Anne Grigg Apr 22, · Write off invoices in QuickBooks Online Accountant Go to Accountant Tools and select Write off invoices. Set the Invoice Age, To Date, and Balance less than filters to find the invoice. Then, select Find invoices. Review the name in the Customer column. Select the checkboxes for the invoices you Apr 25, · Select the Account field and choose Accounts Payable from the dropdown list. Enter the amount under the Debit column, tab to the Name column and select the vendor name from the dropdown list. In the next line, select the offset account and enter the amount under the Credit column. Select Save & blogger.comted Reading Time: 5 mins

No comments:

Post a Comment